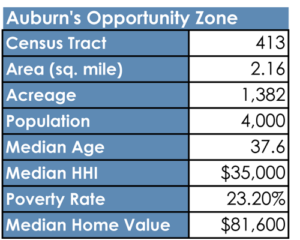

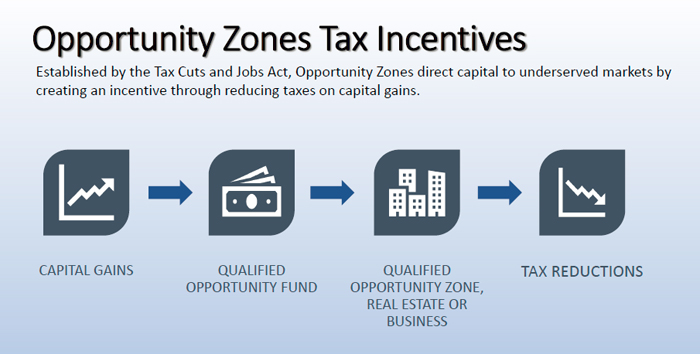

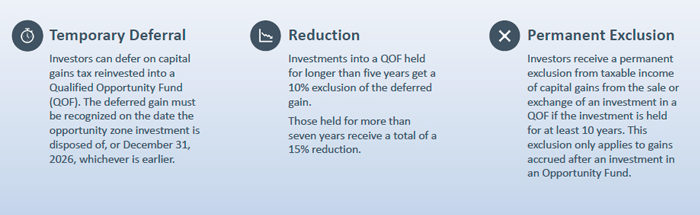

In Cayuga County, the northwest quadrant of the City of Auburn is a Qualified Opportunity Zone. The federal Opportunity Zone program is an economic development tool designed to spur long-term, private capital investment in distressed areas by providing tax benefits to investors. This new program provides tax incentives for those who invest their capital gains as equity for businesses or real estate projects within a designated zone. They receive an immediate tax break, and can eliminate tax on future capital gains, if they make a long-term investment.

Auburn Opportunity Zone Prospectus

The Cayuga Economic Development Agency, in partnership with the City of Auburn, hosted an informational workshop about the new federal Opportunity Zones program on March 4, 2019, at Auburn City Hall. To view a video of the workshop, click here.

City of Auburn, NY – Zoning Map and permissible uses

Seven Cayuga County Craft Beverage Producers Secure State Grants Totaling over $280K

Seven Cayuga County Craft Beverage Producers Secure State Grants Totaling over $280K

CEDA: Auburn, economic hub of Cayuga County

CEDA: Auburn, economic hub of Cayuga County

Micron Community Feedback

Micron Community Feedback

What your investment in the Cayuga Economic Development Agency has created

What your investment in the Cayuga Economic Development Agency has created

Auburn DRI Small Project Grant Fund: Learn more on 10/19!

Auburn DRI Small Project Grant Fund: Learn more on 10/19!